Mr. Market’s psychological transition from manic last year

to depressive this year has been mirrored by the behaviors of the Select

Sector SPDRs dividing the S&P 500 into nine pieces, as reported in “Utilities No. 1 Among Select Sector SPDR ETFs In

2014 As Of Mid-April” at Seeking Alpha.

The Utilities SPDR exchange-traded fund (XLU) was the best performer among

its peers during the first third of 2014, as its adjusted closing share price advanced

to $43.21 from $37.66, a gain of $5.55, or 14.74 percent. By way of comparison,

the SPDR S&P 500 ETF (SPY)

climbed to $188.31 from $183.88, an increase of $4.43, or 2.41 percent.

Accordingly, I am happy to have XLU as the first of a

baker’s dozen ETFs to be featured this month in a J.J.’s Risky

Business blog series being launched today. Basically, I will be looking

at each ETF with both eyes fixed on its Coppock guide, as was the case in “SPY Coppock Guide: Away From Bullishness, Toward

Nonbullishness as of March 31, 2014.”

The Coppock guide, aka either the Coppock curve or the Coppock

indicator, is a long-term indicator of price movements in major stock-market

indexes introduced by Edwin S. Coppock in Barron’s

more than half a century ago. Both the indicator’s history and its methodology

are interesting in themselves, but my focus now is on its relevance to XLU.

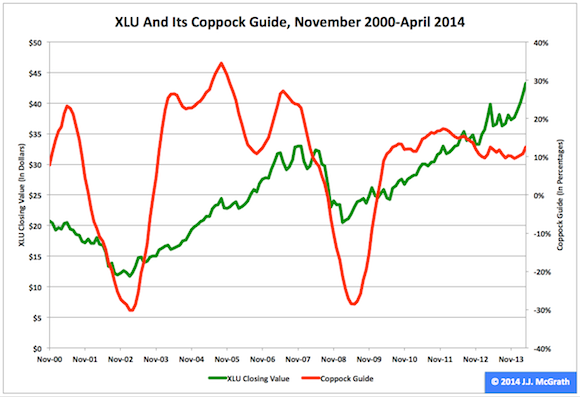

Figure 1: XLU And Its

Coppock Guide, The Complete History

Note: The XLU

closing-value scale is on the left, and the Coppock guide scale is on the

right.

Source: This J.J.’s

Risky Business chart is based on

proprietary analyses of Yahoo Finance adjusted monthly share-price data and those data themselves.

Coppock developed his long-term guide not to generate both

bullish and bearish signals but to generate only bullish signals. However, I

employ it to generate either bullish or nonbullish signals. It is extremely

important to keep in mind that in the context of the Coppock guide a nonbullish

signal is not equivalent to a bearish

signal. In my use of the indicator, I anticipate XLU may advance after a bullish

signal and expect it might do anything following a nonbullish signal

(i.e., trade higher, lower or sideways).

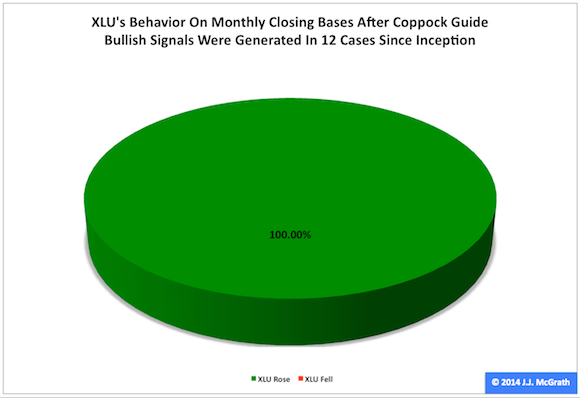

Figure 2: XLU’s

Behavior Subsequent To Initial Bullish Signals

Source: This J.J.’s

Risky Business chart is based on

proprietary analyses of Yahoo Finance adjusted monthly share-price data.

The XLU Coppock guide’s initial bullish signals collectively

have compiled a perfect record in prognosticating the future upward movements

of the ETF on monthly closing bases, as they have been accurate in all 12 cases

since November 2000. The most recent bullish signal was generated last

December, when XLU’s closing share price was $37.66.

Because of a one-month lag in the confirmation of a Coppock

guide signal, however, I used XLU’s closing share price of $38.78 in January as

the baseline in determining the success or failure of the latest signal. As

mentioned above, the ETF’s final print was $43.21 in April.

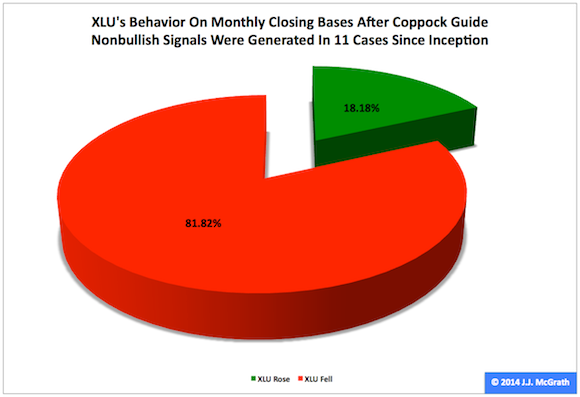

Figure 3: XLU’s

Behavior Subsequent To Initial Nonbullish Signals

Source: This J.J.’s

Risky Business chart is based on

proprietary analyses of Yahoo Finance adjusted monthly share-price data.

The XLU Coppock guide’s initial nonbullish signals

collectively have compiled a pretty interesting track record of their own. Keeping

in mind that in the context of the Coppock guide a nonbullish signal is not equivalent to a bearish signal, XLU since

November 2000 has fallen on nine occasions, or 81.82 percent of the time, and

risen on two occasions, or 18.18 percent of the time, in the wake of nonbullish

signals.

I monitor XLU because I believe it is key to any analysis of

market sentiment based on the comparative behaviors of the nine Select Sector SPDRs. If XLU

ranks either at or close to No. 1 in relative returns during a given period,

then I think market participants are generally in risk-off mode; if XLU ranks

either at or close to No. 9 in relative returns over a given period, then I

think market participants are generally in risk-on mode.

Author’s Note: This first

blog post in a series centered on the Coppock guides of 13 important ETFs is

being cross-posted at both J.J.’s Risky

Business and J.J. McGrath’s Instablog on

Seeking Alpha. The rest of the series will be posted at the former location.

You can follow me (and the series) @JJMcGrath3000 on Twitter, at JJMcGrath on StockTwits and via myself on Google+.

Disclaimer: The opinions expressed

herein by the author do not constitute an investment recommendation, and they

are unsuitable for employment in the making of investment decisions. The

opinions expressed herein address only certain aspects of potential investment

in any securities and cannot substitute for comprehensive investment analysis.

The opinions expressed herein are based on an incomplete set of information,

illustrative in nature, and limited in scope. In addition, the opinions

expressed herein reflect the author’s best judgment as of the date of

publication, and they are subject to change without notice.

No comments:

Post a Comment