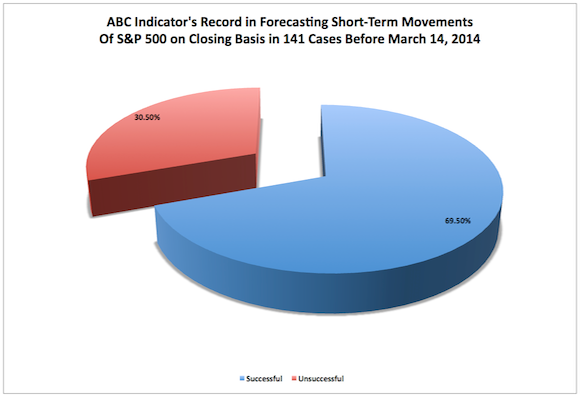

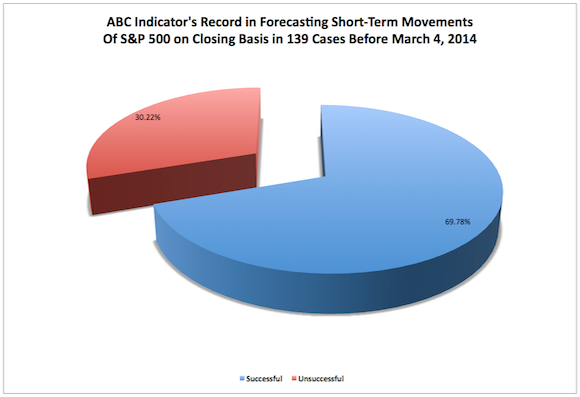

Accordingly, the overall results were in line with the ABC

Indicator’s history, which before the launch of the now-completed test suggested

they would be successful between six and eight times and unsuccessful between

two and four times. Since assuming its current form on July 6, 2009, the indicator’s

performance in forecasting the short-term direction of the U.S.

large-capitalization index on a closing basis can be summarized as follows:

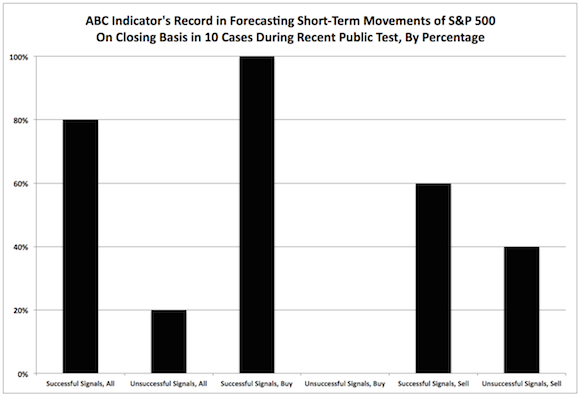

• Its signals have been correct on 99 occasions, or 69.72

percent of the time, and incorrect on 43 occasions, or 30.28 percent of the

time.

• Its Buy signals

have been right on 57 occasions, or 80.28 percent of the time, and wrong on 14

occasions, or 19.72 percent of the time.

• Its Sell signals

have been right on 42 occasions, or 59.15 percent of the time, and wrong on 29

occasions, or 40.85 percent of the time.

During the ABC Indicator’s recent public test at J.J.’s Risky Business, it produced as

follows:

• In the case of the Buy

signal on Dec. 20, the S&P 500 on a closing basis rose to as high as

1,848.36 on Dec. 31 from 1,809.60 on Dec. 19. Successful.

• In the case of the Sell

signal on Jan. 3, the index on a closing basis fell to as low as 1,826.77 on

Jan. 6 from 1,831.98 on Jan. 2. Successful.

• In the case of the Buy

signal on Jan. 10, the S&P 500 on a closing basis rose to as high as

1,842.37 on Jan. 10 from 1,838.13 on Jan. 9. Successful.

• In the case of the Sell

signal on Jan. 14, the index on a closing basis rose to 1,838.88 that day from

1,819.20 on Jan. 13. Unsuccessful.

• In the case of the Buy

signal on Jan. 15, the S&P 500 on a closing basis rose to as high as

1,848.38 that day from 1,838.88 on Jan. 14. Successful.

• In the case of the Sell

signal on Jan. 24, the index on a closing basis fell to as low as 1,741.89 on

Feb. 3 from 1,828.46 on Jan. 23. Successful.

• In the case of the Buy

signal on Feb. 11, the S&P 500 on a closing basis rose to as high as

1,859.45 on Feb. 28 from 1,799.84 on Feb. 10. Successful.

• In the case of the Sell

signal on March 4, the index on a closing basis rose to 1,873.91 that day from

1,845.73 on March 3. Unsuccessful.

• In the case of the Buy

signal on March 5, the S&P 500 on a closing basis rose to as high as 1,878.04

on March 7 from 1,873.91 on March 4. Successful.

• In the case of the Sell

signal on March 14, the index on a closing basis fell to as low as 1,841.13

that day from 1,846.34 on March 13. Successful.

Source: This chart is

based on J.J.’s Risky Business

proprietary data.

Related Reading

Disclaimer: The opinions

expressed herein by the author do not constitute an investment recommendation,

and they are unsuitable for employment in the making of investment decisions.

The opinions expressed herein address only certain aspects of potential

investment in any securities and cannot substitute for comprehensive investment

analysis. The opinions expressed herein are based on an incomplete set of

information, illustrative in nature, and limited in scope. In addition, the

opinions expressed herein reflect the author’s best judgment as of the date of

publication, and they are subject to change without notice.